Margin information

Review our margin requirements and other information related to margin trading with Saxo

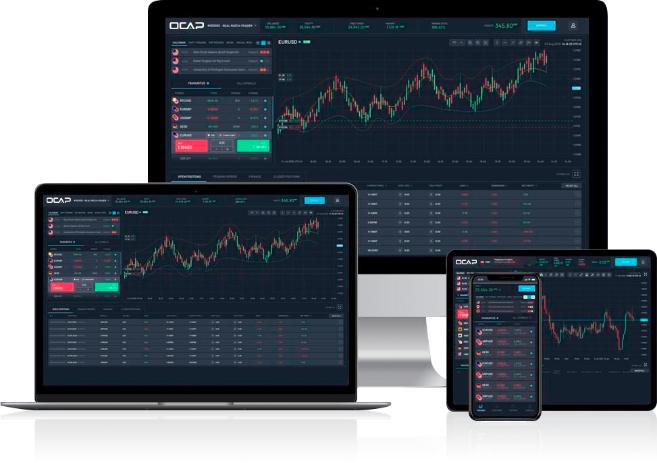

RegisterOCAP provides the industry’s top trading conditions, featuring highly competitive spreads across a broad selection of currency pairs and other assets. View our comprehensive list of over 50 FX pairs, along their respective spreads and margins, for our CFD accounts below.

|

|---|

Spreads taken from competitor website as of 20 September 2023.

(Professional clients only)

Saxo Markets allows Professional clients to use a percentage of certain stock and ETF investments as collateral for margin trading activities. The collateral value of a stock or ETF position depends on the rating of the individual stocks or ETFs – please see conversion table below.

Collateral rates for stocks and ETFs

Example: 75% of the value of a position in a Stock or ETF with Rating 1 can be used as collateral (instead of cash) to trade margin products such as Forex, CFDs, Futures and Options. Please note that Saxo Markets reserves the right to decrease or remove the use of Stock or ETF investment as collateral for large position sizes, or stock portfolios considered to be of very high risk.

| Rating | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Collateral value of position | 75% | 50% | 50% | 25% | 0% | 0% |

Saxo Markets allows Professional clients to use a percentage of certain bond investments as collateral for margin trading activities.

The collateral value of a bond position depends on the rating of the individual bond, as outlined below:

| Rating definition* | Collateral percentage |

|---|---|

| Highest Rating (AAA) | 95% |

| Very High Quality (AA) | 90% |

| High Quality (A) | 80% |

* as rated internally by Saxo Group

Example: 80% of the market value of a bond position with an A rating can be used as collateral (instead of cash) to trade margin products such as Forex, CFDs, or Futures and Options.

Please note that Saxo Group reserves the right to decrease or remove the use of bond positions as collateral.

Access highly competitive spreads and commissions across all asset classes, and receive improved rates as your trading volume increases.

Commissions from

2 ¢Per share

Or 0.09%

Commissions from

0.5

On EUR/USD

Commissions from

0.8

US 500

Spreads from

0.2

On spot gold

1.50USD, EUR, CHF, GBP

+ Exchange commission

0%

Commissions from

0.10%

US 500

0.10%

min 6.50 USD

Commission as low as

0.20%

min 50 CHF

0.15%

min 8 CHF

Trade 71,000+ assets with no minimum deposit