FAQ’s

Common queries, clarified. Keeping you informed.

RegisterPlease read the following documents before applying for a Saxo account: General Business Terms, Order Execution Policy, Conflict of Interest Policy, and Risk Disclosure Notice.

We're required to collect a national ID number (National Insurance for UK taxpayers) from all clients. If through the application process we're unable to verify your identity electronically, we may also need a picture of your proof of ID (e.g. driver's license) and proof of address (e.g. utility bill).

For a comprehensive overview of our industry-leading spreads and commissions and details of additional costs, click here.

As we’re regulated and authorised by the Financial Conduct Authority, when you make a deposit into a Saxo account, your money is guaranteed as:

It’s quick and easy to open a Saxo account: just fill in our simple online form and submit any supporting documents such as your ID or proof of address if required.

You can fund and deposit your Saxo account with 18 different currencies, and open sub-accounts to switch between different currencies. Sub-accounts are only available to Platinum and VIP clients. You can learn more about your account tier by visiting your Saxo Rewards page.

Your Saxo account provides access to more than 71,000 instruments across asset classes, and products including FX, CFDs, ETFs, stocks, bonds, and more. Find out about our range of tradable markets, here.

You can transfer your existing stock portfolio to Saxo after you have opened your account. Log in to the platform, go to the ‘Account’ section, select ‘Deposits and Transfers’ and then ‘Portfolio Transfer’.

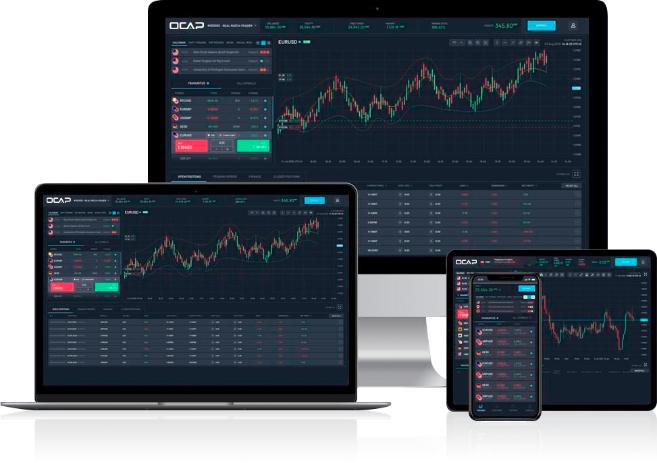

Trade 71,000+ assets with no minimum deposit